block input tax malaysia list

Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. If taxable you are required to fill in M Form.

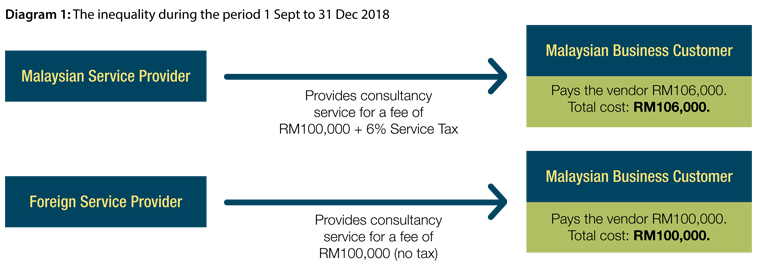

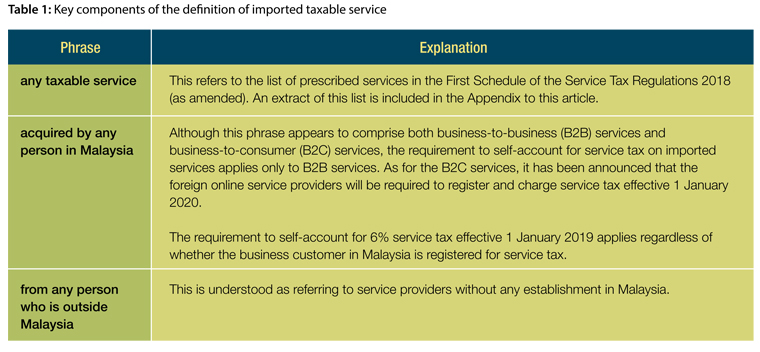

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Receiving tax exempt dividends.

. 030 Malaysian ringgits MYR per litre is applicable. Blocked credit list Section 175 1. The goods or services are supplied to you or imported by you.

Section 175 of GST Act deals with the blocking of ITC on specified inward supplies. Conditions for claiming input tax. When a company chooses not to claim input tax credit due to administrative reasons eg.

Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas. 14 Income remitted from outside Malaysia. So that makes a grand total of RM14000.

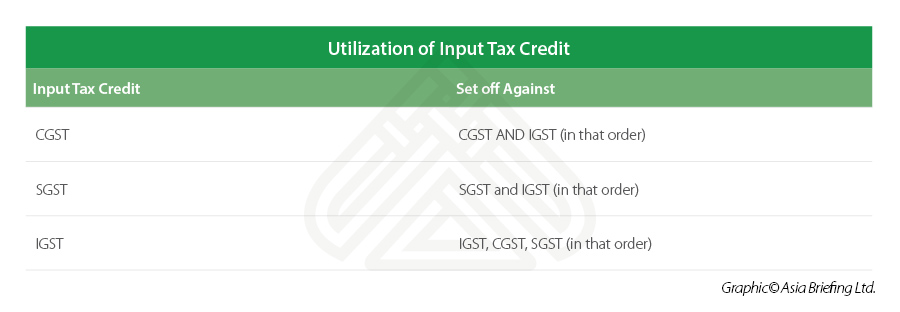

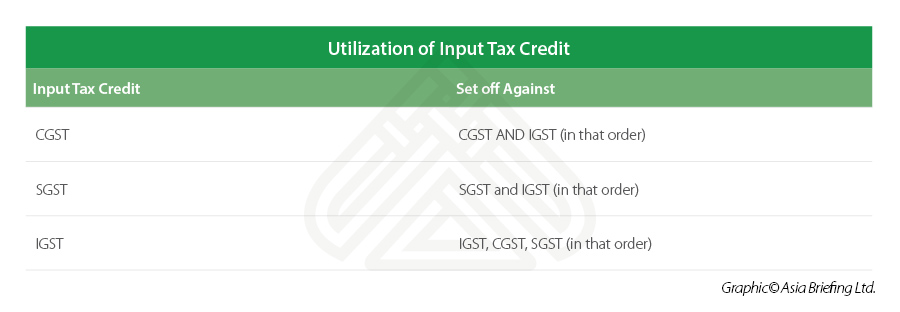

ITC is used for payment of output tax. Property tax 62 Tax on unused land 63 Registration tax transfer tax stamp duty 46. GST is collected by the businesses.

In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in Malaysia. 2 Taxable person means any person who is or is liable to be registered under section 2 GSTA. According to the DG decision 42014 amended 28 October 2015 1 GST shall be charged by a taxable person in the course or furtherance of business on any taxable supply of goods or services made in Malaysia section 9 GSTA.

Blocked input tax refers to input tax credit that you cannot claim. 1 on first RM100000 RM1000. Recovery of input tax Time limit for making claim of input tax Tax invoice Records and retention period.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in. RM150000 RM4000 ii The garment manufacturer is entitled to claim input tax since the value of exempt supplies is less than RM5000 per month and does not exceed 5 of the total value of all supplies. For individual taxpayers ensure that the following information is included in the payment slip.

It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. You can claim input tax incurred on your purchases only if all the following conditions are met. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products.

But there are some cases where ITC is blocked so that recipient is not able to claim ITC. As a non-resident youre are also not eligible for any tax deductions. The goods or services.

3 on next RM100000 RM3000. 2 on next RM500000 RM10000. GST was only introduced in April 2015.

INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No. A specific Sales Tax rate eg. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. 12017 Date of Publication. Which would be taxable supplies if made in Malaysia.

For GST Malaysia there are 3 types of supply. Note that only cash payments are accepted at Pos Malaysia outlets. GST paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly GST returns.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. GUIDE ON INPUT TAX CREDIT As at 4 JANUARY 2017. 03-21731288 Printed in Malaysia by SP-Muda Printing Services Sdn Bhd 906732-M.

Specific rates of sales tax are currently only imposed on certain classes of petroleum generally refined petroleum. Standard-rated supplies are goods and services that are charged GST with a standard rate. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income.

Block input tax malaysia list Friday January 7 2022 Edit. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Bhd a GST registered International Procurement Center undertakes procurement and sale.

Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in Malaysia. Income Tax NumberEmployer number. An approved resident individual under the Returning Expert.

The ad valorem rates are 5 or 10 depending on the class of goods. Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia. The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6.

In one of the examples in the PR IRB explained that the company could have. At this point in time the rate may be slightly higher. Imposition of Sales Tax 4.

8 June 2017 Page 4 of 38 regarded as making a taxable supply and is eligible to claim GST paid or to be paid on goo ds and services acquired or imported by him input tax. Ouch This is how much your Property Stamp Duty or MOT Stamp Duty would cost you for a RM700000 property. SST is administered by the Royal Malaysian Customs Department RMCD.

Under section 8 of the Sales Tax Act 2018 sales tax is charged and levied on all taxable goods. In the absence of a tax invoice or valid tax invoice the company is not entitled to claim a deduction by virtue of section 391o of the ITA. The income tax with the highest rate only recently being at 28 has been cut down now to 26 for residents and 27 for non-residents.

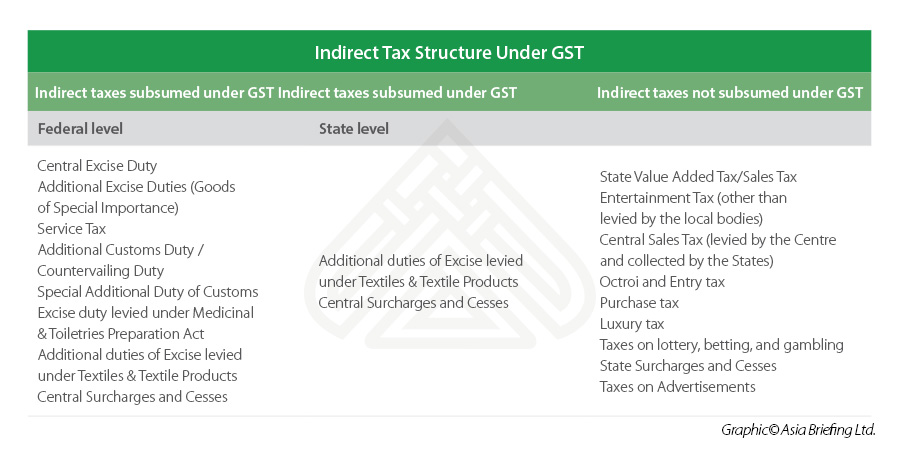

The USG routinely intercepts and monitors communications on this IS for purposes including but not limited to penetration testing COMSEC monitoring network operations and defense personal misconduct PM. Service tax is a consumption tax levied and charged on any taxable services provided in Malaysia by a registered person in carrying on ones business. ITC being the backbone of GST and there are many condition to claim ITC on any items.

50706 Kuala Lumpur Malaysia Tel. Under GST businesses are allowed to claim GST incurred on purchase of most goods and services.

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Supported Composite Data Types For Electronic Reporting Formulas Finance Operations Dynamics 365 Microsoft Docs

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

Fiori App Library List Tutorial S 4hana Sap Blogs

Administering The Value Added Tax On Imported Digital Services And Low Value Imported Goods In Technical Notes And Manuals Volume 2021 Issue 004 2021

Sap Query Browser List Of All Analytical Queries Views In S 4 Hana 2020 Sap Blogs

Fiori App Library List Tutorial S 4hana Sap Blogs

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

3 0 101 Schedule K 1 Processing Internal Revenue Service

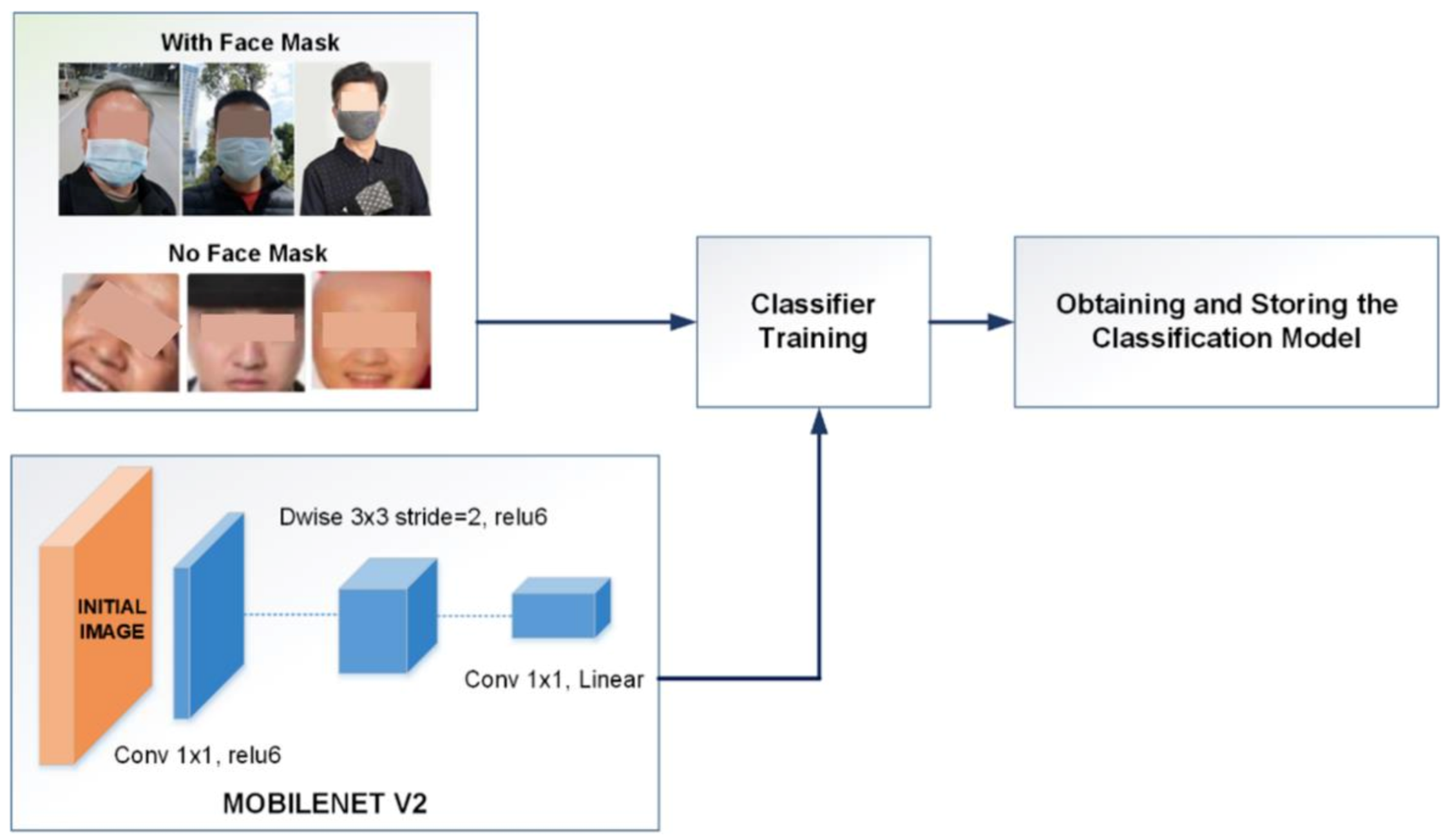

Sustainability Free Full Text Facial Recognition System For People With And Without Face Mask In Times Of The Covid 19 Pandemic Html